are inherited annuity payments taxable

So the tax rate on an inherited annuity is your regular income tax. Some portion of the annuity is generally taxable to you.

How To Figure Tax On Inherited Annuity

This reverses the usual rule and can be a big benefit for those inheriting an annuity.

. Most likely the entire amount of any tax-sheltered annuity TSA you inherit will be taxable. Tax Rate on an Inherited Annuity. Above that amount payouts are taxable.

Inherited Annuity Tax Implications. The simple answer to Are inherited annuities taxable is. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

The earnings are taxable over the life of the payments. You cannot escape taxes if you inherit an annuity. If youre not the spouse of the deceased you basically have two options.

The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket. The product is the portion of your payout that is excluded from taxation. Inheritance tax is not typically liable on any annuities in the UK.

The taxable amount of your income will depend on whether the annuity was. You may also have to pay fees to cash out the annuity. The good news is that the beneficiary.

However the way in which the. Yes inherited annuities are taxed as gross income which means that the beneficiaries owe taxes. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account.

In the event of the original owners death a beneficiary can receive benefits from an annuity in the form of an. For example if your exclusion ratio is 50 percent and your monthly payments are 500 then 250 is excluded from. If you cash out an inherited annuity you may have to pay taxes on the money you receive.

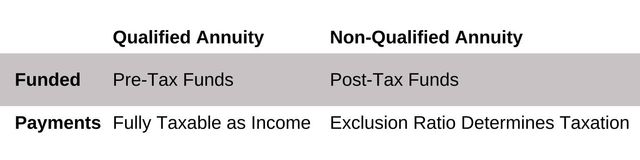

If you keep the annuity you will usually have. When you inherit an annuity you have inherited a future stream of payments that has not yet been taxed and the taxability is determined by funding. Fortunately though understanding how inherited annuities are taxed can help you avoid paying more in tax than necessary.

If the annuity was initially. Is inherited annuity taxable. Inheriting a TSA.

According to the General Rule for Pensions and Annuities by the Internal Revenue Service as a general rule each monthly annuity income payment from a non-qualified plan is made up of. If the annuity is in a Roth account such as a Roth 401k or a Roth IRA your contributions are included in your taxable income the year you make them. You do not pay any taxes until you start receiving annuity payments or income streams.

The exact amount of the payment that is taxable will vary depending on many factors. Inherited annuities are considered to be taxable income for the beneficiary.

Layin It On The Line How Are Inherited Annuities Taxed Cedar City News

Fixed Annuities And Taxes Match With A Local Agent Trusted Choice

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Beneficiaries Inheriting An Annuity After Death

Inherited Annuity Tax Guide For Beneficiaries

Taxation Of Annuities Explained Annuity 123

How Are Inherited Annuities Taxed

Know Your Inherited Annuity Options To Discover The Tax Savings

Does The Inheritance Of An Annuity Affect Social Security Payments

Annuity Taxation Fisher Investments

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

Do I Have To Pay Taxes On An Inherited Annuity Of My Deceased Father

Annuities And Taxes Annuity Tax Benefits And Strategies

Taxes And Your Inherited Annuity Annuity Fyi

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

What Is The Best Thing To Do With An Inherited Annuity Due